1 Feb 2024

What SMEs Want: How to Sell Small(er) Group Life & Health

2024 is promising to be a very good year, especially since PALIG producers have an opportunity-rich market to prospect: small and medium-size enterprises (SMEs).

As you know, the SME market is huge, and our group life and health products are highly competitive. However, in order to reach smaller employers, you must understand their needs and speak their language.

To that end, let’s examine the SME market—and how to prospect it most effectively.

The Vast Scope of the SME Market

At PALIG, we define SMEs as businesses with 5- 50 employees, although in some areas, the maximum is 25 lives. Despite their relatively small size, SMEs play a major role in most countries’ economies. Not only do they make up the majority of employers, they drive job creation and economic development.

According to the World Bank, small and midsize companies represent 90% of all businesses and more than half of global employment, creating seven out of 10 jobs in some countries.

So, while a business with 10, 20 or 30 employees may seem small compared to your large corporate clients, there are many, many prospects out there. Once you sell a few cases and establish yourself as a knowledgeable resource, the sky’s the limit.

Business Trends Impacting SMEs

SMEs are heterogeneous—one size does not fill all. The benefit requirements of a six-life group, for example, may be quite different from those of a fast-growing business with several dozen employees. In addition, situations vary by industry, location and other factors.

But they are all impacted by certain business trends and realities. For example, surveys show that smaller employers are especially wary of the impact of inflation on their business. In addition, many report difficulty hiring and retaining personnel, just like their larger counterparts.

So, while SMEs are cost-sensitive, they increasingly value benefits as a compelling recruiting and retention tool.

Understanding the SME Mindset

Every SME is unique; it’s your job to learn what makes each one tick. However, recent research by McKinsey may help simplify the process.

After carefully studying a pool of SMEs, McKinsey identified five distinct SME customer profiles, each with its own employee benefits preferences. The five types are those who:

- Prefer to rely on experts for benefits guidance/plan design recommendations

- Would rather do their own research and make independent decisions

- Resent spending time on insurance, but want the best deal

- Prioritize carrier reputation and crave more direct access to them

- Prize a single comprehensive solution, provided by one insurer

Try identifying your prospects through this particular lens—it may help you quickly calibrate your best approach and offer solutions most likely to resonate with each one.

5 Things SMEs Want from their Employee Benefits

Choosing (and changing) employee benefits is serious business for SMEs. These factors inform their decision-making, so keep them on your radar.

- Affordability: SMEs are typically more budget-conscious than larger corporations; as a rule, focus on cost-effective/high-value plan designs. For example, when quoting life insurance, explain the value of adding AD&D—a highly-affordable way to multiply coverage. When quoting health plans, offer a higher-deductible option for comparison’s sake, as well as varied cost-sharing options between employers and employees.

- Customization: Even small employers want tailored insurance coverage. Take advantage of PALIG’s plan design flexibility to give each group a customized plan. Our underwriters are always here to help you better meet each client’s needs.

- In-demand Healthcare Benefits: Wellness benefits. Telehealth services. Prescription drug coverage. Smaller groups want these in-demand benefits, too—and many PALIG plans offer them. Be sure you’re broadcasting this to SME prospects for the get-go.

- Long-Term Stability: SMEs want sustainable benefits, provided by a strong, reliable carrier standing behind them. Make PALIG’s consistently stellar insurance ratings and 113-year track record central to all of your presentations.

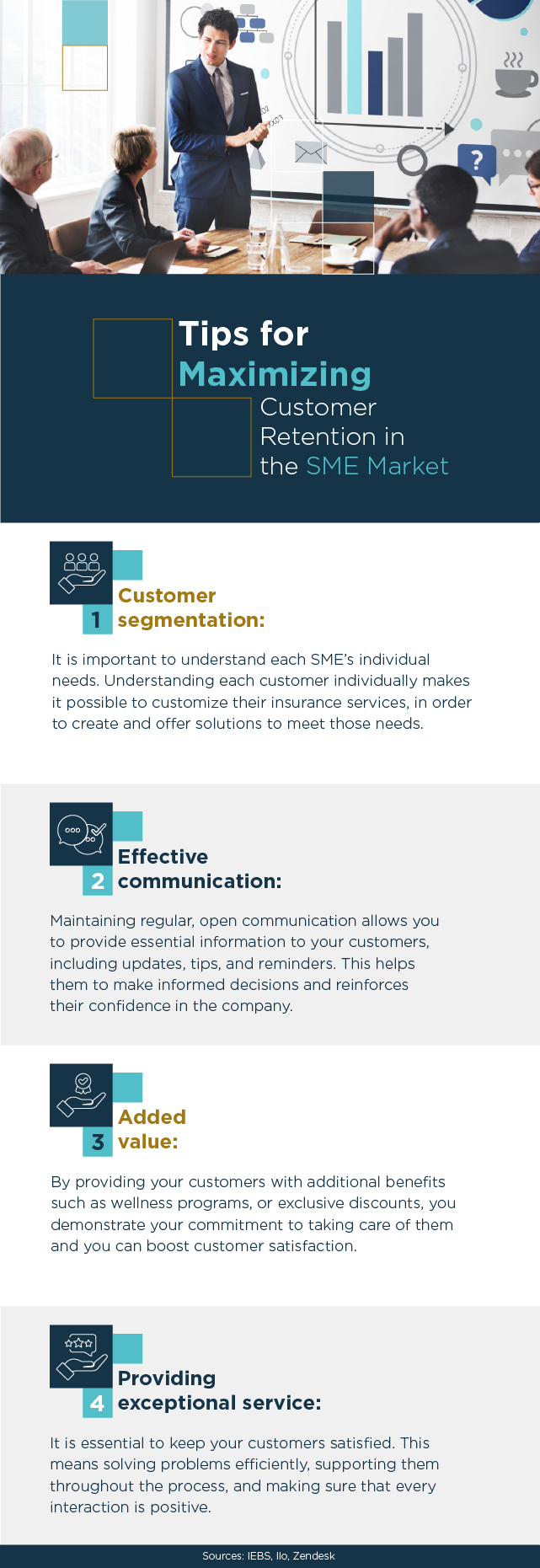

- A Superior Client Experience: Research indicates that customer experience will be a key differentiator in 2024. Communicate thoroughly and frequently. Operate transparently. Educate your clients about their benefits—and offer to educate their employees, too. Giving smaller groups the same attentive, personalized service larger companies enjoy is a sure way to win them over.

Finally, keep in mind: McKinsey’s research also revealed that, while SMEs are largely loyal to their insurance carriers, they are more likely to switch right now. More than 40% are thinking about changing carriers or have already done so, due to changes in their business and/or increasing premiums.

That means now is the perfect time to explore the SME market. You have the tools and products to do so—and we’re here to support you every step of the way.