27 Jan 2023

Acknowledging Loss: How to Talk to Grieving Clients

Estimated read time: 3 minutes

As an insurance advisor, you have the privilege of celebrating the happiest moments of your clients’ lives: weddings, new homes, new babies. On the flip side, you also have a role to play during their deep personal losses, such as death and divorce.

Nurturing client relationships means finding quiet ways to be of service during those difficult times.

Admittedly, this is no small task. If you have yet to experience this, you might ask the veteran producers in your office for their recommendations. In addition, draw on your own personal experience, so you can act from a place of authenticity. Finally, consider the following best practices, which may be helpful when you’re unsure how to proceed.

Balance Professionalism with Empathy

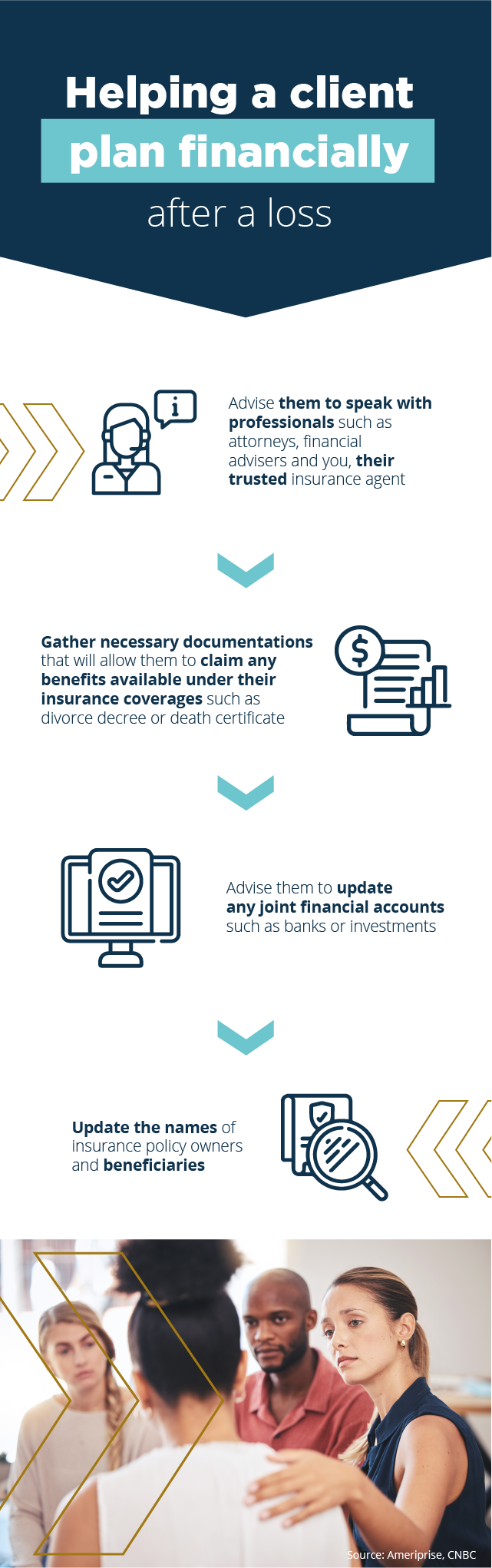

Obviously, it is your immediate responsibility to help grieving clients address any urgent business related to their loss, such as filing death claims or updating beneficiaries. However, now is the time to lead with your E.Q. (Emotional Intelligence) over business efficiency. When someone is grieving, empathy comes first.

- Listen More than Talk

Many people deal with grief by talking about their loss, which is why, many times, simply offering a compassionate ear is the best thing to do. While it may feel awkward, giving your clients the gift of your time and attention can make a real difference. - Consider Attending the Funeral

Undoubtedly, you have closer relationships with some clients than others. In those instances, it may be appropriate to attend a client’s funeral or visitation. This is something to weigh case by case, based on your relationship with the family and your comfort level. - Make a Donation in Your Client’s Honor

One meaningful way to honor your client’s life is by donating to a cause near and dear to their hearts. Often, specific charities are listed in obituaries; you might also review your client’s file for insights. - Bring the Paperwork to Them

If there are claim forms to be completed or death certificates to be collected, offer to meet your client’s survivors in their home—and don’t arrive empty handed. Bring lunch, a fruit basket or a bouquet, etc. Even if this is new for you, it is better to err on the side of thoughtfulness.

Let Each Client Set the Pace

People react to loss differently. Some bereaved clients may wish to file a death claim immediately. Newly-divorced parents may wish to increase their life insurance benefits right away. Others may not be ready to deal with such things—and that’s fine, too.

Either way, it’s your responsibility to tell your clients what they need to know at the moment—particularly if life insurance is involved—and then take your cue from them. Some clients may seek reassurance that they have enough funds for the future or that their benefits are adequate. When clients ask for specific information, be ready to provide it.

Otherwise, offer to help, let them know that you’re there when they’re ready, and then check in with them occasionally in a low-key way.

Keep in mind: when people are grieving, they aren’t thinking clearly .“Grief brain” is a real, physiological condition in which the brain is flooded with stress hormones and chemicals. It can cause anxiety, panic, confusion—even the fight or flight response.

While not everyone experiences this level of loss, the last thing a grieving client should do is to make important financial decisions. During this time, the best thing to do is make sure their policies remain protected and in-force—period.

In addition, be sure to promptly update your client files or, if you use one, your customer relationship management (CRM) system. This will ensure that your office does not inadvertently send Christmas cards, prospecting letters, etc. to, say, a deceased client’s widow or to a couple who is no longer together.

Be There Through Thick and Thin

Certainly, one of the most gratifying aspects of our profession is helping people plan for the future and provide for their loved ones—and to make sure that families receive those benefits promptly after a loss.

But the dark side of that is that insurance advisors tend to witness more loss than many in other professions. It’s important to develop strategies for handling it, while keeping it in perspective.

When you are there for your clients in the best of times and the worst of times, you are performing a valuable service—and you will have those clients for life.