26 Sep 2022

A Fresh Look at Supplemental Coverages—and the Essential Role They Play

Estimated read time: 4 minutes

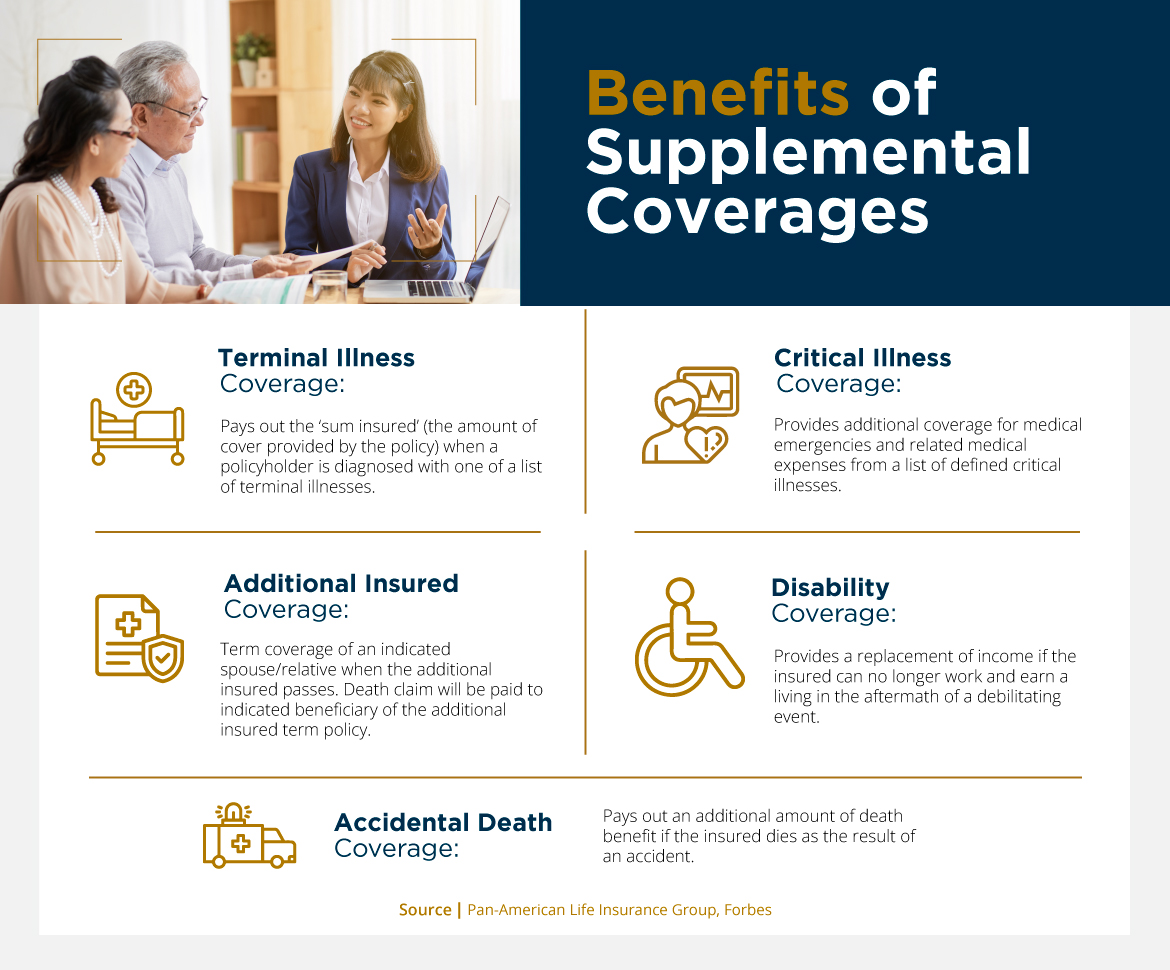

Every so often, it pays to view the products that make up your portfolio with fresh eyes. Take supplemental health insurance coverages. It’s easy to think of these as add-ons, as nice-to-haves, but they are far more than that, especially now.

Personal health and finances have always been among people’s greatest worries—and between the hard-learned lessons of COVID-19 and the looming threat of global recession, that’s truer than ever today.

Many families are more security-minded now, which is where supplemental coverages come in to play. Not only do they fill the gaps in primary health insurance, they can shield a family’s assets against catastrophic medical bills—at a very reasonable cost.

Just as accident insurance enhances the value of life insurance, ancillary health coverages—critical illness and cancer coverage, high-deductible supplement insurance, even dental and vision benefits—enhance the value of health insurance.

For your clients and prospects who care about being more fully protected—or have reason to—this is a conversation worth having.

The Growing Medical Debt Crisis

Medical debt is a real and growing problem. According to a recent study by the Kaiser Family Foundation (KFF), 41% of Americans carry medical debt—and it weakens their financial stability.

Specifically, of the nearly 2,400 people KFF surveyed:

- 24% have medical bills that are past due or that they can’t pay

- 21% are using healthcare provider payment plans

- 17% paid their medical bills by credit card, which they’re still paying down

- 17% owe debt to a bank or other lender for funds used to pay medical bills

- 10% owe a friend or relative for funds they borrowed to pay medical bills

In addition, 35% report that their medical debt has hurt their credit score. In fact, the U.S Consumer Financial Protection Bureau found that medical debt is the most common item reported on consumer credit records.

This can limit a family’s ability to make major purchases, save for college and/or retirement, and generally move forward, improving the next-generation’s quality of life.

And it’s not just an American problem; it’s a global problem. In Latin America, for example, medical debt has soared as a result of COVID-related expenses.

For example, one Reuters’ report documented how in Peru, families sold their homes and pawned their belongings to pay for loved ones’ hospital bills. In Paraguay, people held bake sales and resorted to taking out short term loans so their family members could receive treatment.

In fact, one Latin American economic researcher has noted that health expenses are currently the main driver pushing citizens into debt.

But wherever you are, this doesn’t need to happen to your clients—and supplemental insurance products can help prevent that, keeping families current on their medical bills and on track with their long-range savings plans.

Helping Clients Avoid Medical Debt (and Achieve Peace of Mind)

As you know, no health insurance policy is designed to cover everything—it’s a meticulous balance of coverage and affordability.

High-deductible plans and limited-benefit indemnity plans provide cost-effective access to healthcare—something we at Pan-American Life care very much about. But such plans were never intended to be all-inclusive.

Even traditional health plans, with structured deductibles, copays, coinsurance and benefit maximums, have limitations.

Here’s where supplemental insurance policies can act as a safety net, filling in those gaps at minimal cost. When you connect with clients to conduct a policy review, or meet with prospects to discuss their health plan needs, that’s a great time to bring this to their attention.

Ask the question: in the event of a healthcare crisis, would they be able to pay all their designated out-of-pocket expenses? (Keep in mind: in the Kaiser survey, half of the respondents said they would not be able to pay an unplanned $500 medical bill.)

In addition, encourage your clients to consider their family health history. Those predisposed toward, say, heart disease might be thrilled to learn that critical illness coverage exists, while those at higher risk of cancer may find reassurance in purchasing a cancer policy.

Similarly, a client with a high-deductible health plan may welcome an affordable HD supplement plan. Meanwhile, on the group side, offering supplemental coverages on a voluntary basis is an easy way to satisfy employees’ desire for more benefit options—at no cost to employers.

In short, these are valuable tools in your product portfolio, and the possibilities to put them to work are nearly endless. At the end of the day, “supplemental” coverages are far more valuable than their name implies.