29 Jul 2022

More than Ever, Women Need Life Insurance—But They Need a Customized Buying Path, Too

Estimated reading time: 4 minutes

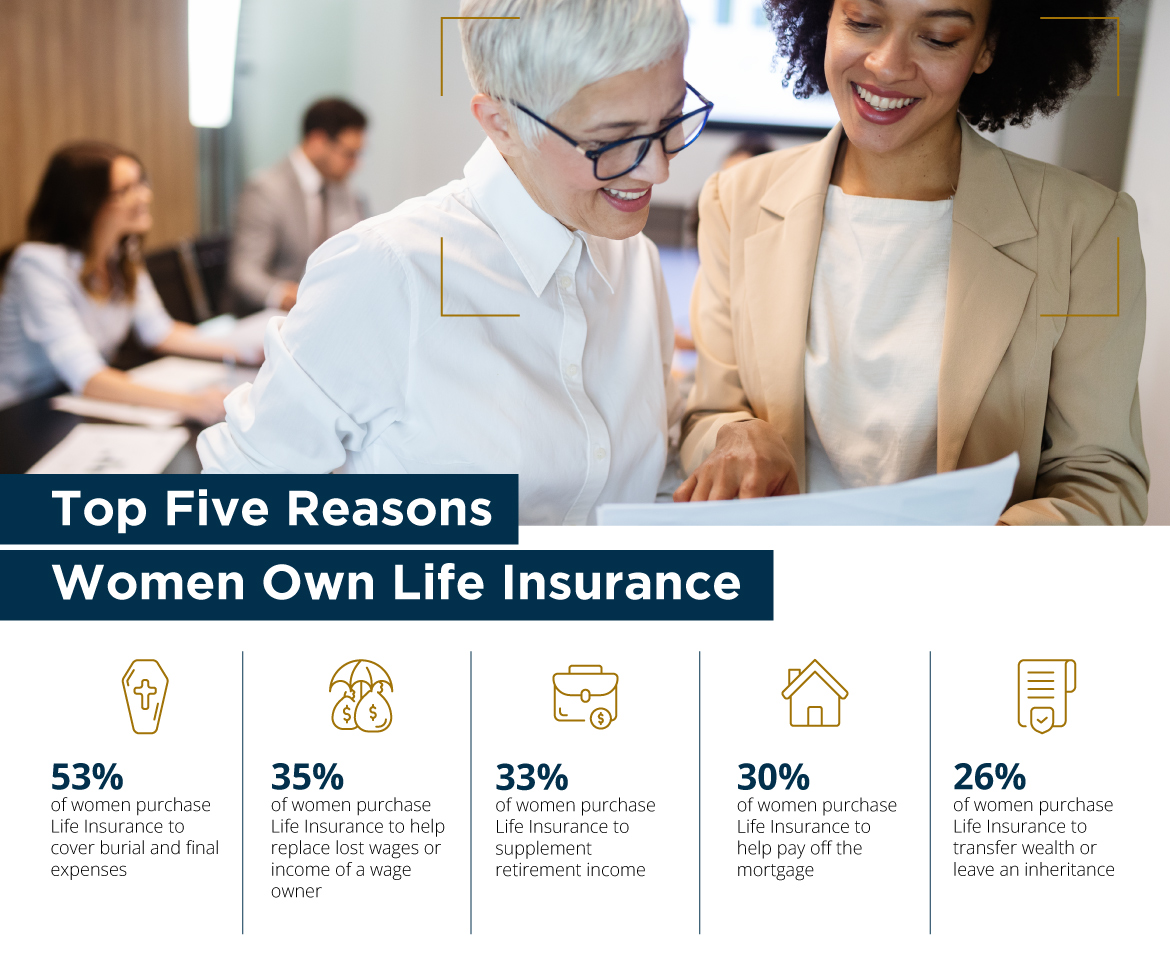

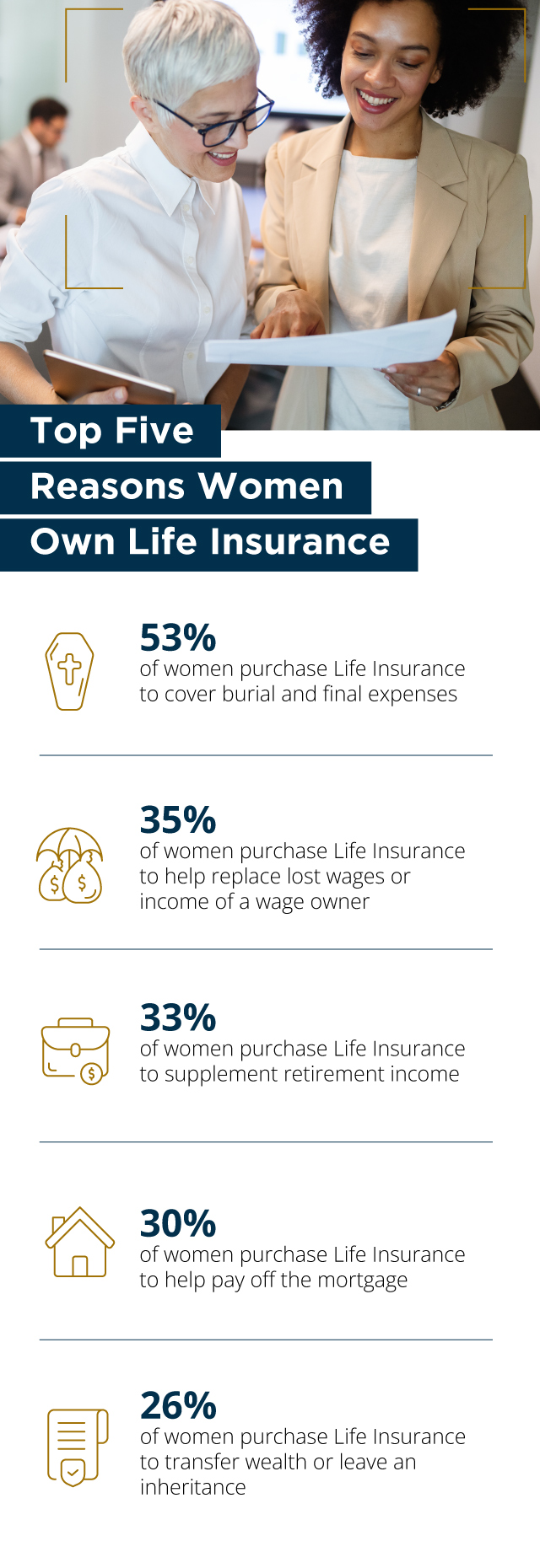

Unquestionably, women need life insurance, for all the same reasons that men do and more. In fact, fewer women have life insurance than men—47% versus 58% of the population, according to a recent LIMRA/Life Happens study. In order to connect with this vastly-underserved market, we need to understand what makes women commit to buying, as opposed to shying away.

Women think about life insurance differently than men do, and because their thought process is different; a successful sales process must be different, too. Fortunately, there is revealing research on this subject—which thoughtful insurance advisors can leverage to better serve this essential yet often-overlooked market.

The #1 Barrier: Women’s Self-perceived Lack of Knowledge

Earlier this year, LIMRA asked women about their financial priorities, what prevented them from buying life insurance, and how the industry could turn that around.

They learned that many women choose not to buy life insurance for one very basic reason: they don’t know what or how much to buy. Intimidated by their self-perceived lack of knowledge, they lack the confidence to believe they could make an informed decision. Furthermore, many expressed fears of getting taken advantage of or being treated differently by producers and carriers.

In addition, these women:

- Overestimated what the cost of life insurance would be, then dismissed it as too expensive without knowing the facts.

- Expressed discomfort over sharing their personal information with people they don’t know or trust.

- Prioritized other financial concerns, including saving for retirement and building an emergency fund.

The good news is, these are all hurdles can all be overcome—when advisors take them seriously and develop strategies for addressing them.

What Insurance Advisors Can Do

The key to winning over female prospects may sound counterintuitive: stop selling and start educating—while listening more closely.

By freely sharing essential facts about life insurance—in a down-to-earth manner, minus the sales pitch—advisors can help women bridge their perceived knowledge gap. In other words, advisors who see their role as educators, not merely producers, will connect more meaningfully with this demographic.

Everyone likes doing business with people they trust, and this is especially true here. Be willing to take more time to build a relationship—to slow down and add more educational touchpoints to your sales process.

In addition, be sure to explain how whole life and universal life insurance can help prospects achieve their other financial goals. According to LIMRA research, women’s three top financial priorities are:

- Saving enough money for a comfortable retirement

- Being able to support themselves if they can’t work, and

- Paying for long-term care if it’s needed

By explaining how features such as cash value and policy loans work, you can help your clients connect the dots between life insurance and these other goals—leading not only to greater financial literacy but more holistic financial planning.

That said, never assume you know what your prospect wants: ask her.

More Ways to Connect with Female Clients

In addition, here’s a number of simple steps advisors can take to educate and appeal to female prospects and clients:

- Hold free educational webinars and/or community presentations with a low-key, no-strings-attached approach.

- If you’re adept at social media, create short informational videos for YouTube and easy-to-consume graphics for Facebook—the most-popular forms of social media for women.

- Keep in mind: eight in 10 women overestimate the cost of life insurance! Freely share generic policy costs for women at various ages and situations—and remind them that life insurance rates are generally lower for women.

- Provide clear guidelines for calculating how much to buy, based not on traditional increments of salary but rather, what a given prospect seeks to protect (such as covering a mortgage or putting a child through coverage). Use a personalized, needs-based approach.

- Remind women who don’t have professional careers that their lives have remarkable value. For example, Salary.com estimates that stay-at-home moms provide nearly $185,000 in labor per year. Replacing a caregiver—whether of children or parents—would be a huge expense, but it’s not something many families think about.

- Assure women that they can still qualify for coverage even with a health history or if they’re pregnant at the time.

The more women know about life insurance and how it works, the more likely they are to want to put it to work for themselves.

The Need is Now

Right now, advisors have a unique outreach opportunity. Remember, during COVID-19, large numbers of women lost their group life insurance due to job loss (LIMRA pegs this figure at 14% in the U.S.).

Advisors who are poised to not only seize the opportunities, but are sensitive to the priorities and preferences of female prospects, will be much better equipped to serve this market—and ultimately, that’s a win/win for everyone.