28 Aug 2019

Mindfulness and Life Insurance

Read time: 5 minutes, 14 seconds

Surely, you are familiar with or have heard of mindfulness. The term encompasses a group of techniques, exercises, and general practices constituting a larger philosophy of life that seeks to unite our bodies and minds. Mindfulness originated from the ancient philosophical methods of Buddhism and Hinduism.

Practicing mindfulness means becoming completely aware of our actions, even seemingly small ones, and focusing our attention on the things we do without passing judgement or developing attachment or rejection toward those experiences.

The practice of mindfulness is similar to meditation in that it allows us to recognize our own emotions, bodily sensations, and whatever is happening around us in a neutral, dispassionate manner, instead of constantly ruminating about our problems or trying to understand their causes and origins. By approaching reality in this way, we can gain an objective perspective, a panoramic and complete picture of our experiences, that will help us make better, more thoughtful and creative choices to improve our well-being and that of the people in our lives. Finally, mindfulness sets us on the path to personal freedom and, consequently, happiness.

In this light, then, it’s easy to understand the link between mindfulness and life insurance, since both tools serve a similar purpose: to help us lead a calmer, fuller, and freer life, giving us the confidence to face the future and its challenges with greater power of choice and peace of mind. Because September is Life Insurance Awareness Month, we wanted to bring up the topic of mindfulness and explain how it relates to buying a life insurance policy.

Life insurance and Mindfulness: Parallel Concepts

The process of buying life insurance is not so different from the practice of mindfulness. In both cases, we must make an effort to concentrate on our personal circumstances and the world around us, learning to abstract and analyze specific situations. If you want to get life insurance, you’ll have to look at the fundamental elements of your life with a calm and level-headed attitude: your general health, your risk factors, your habits, your family’s current and future needs...There is a sense of taking distance from your subjective experiences to gain a more objective, wider view of your life, a technique that forms the basis of meditation as well as mindfulness practices.

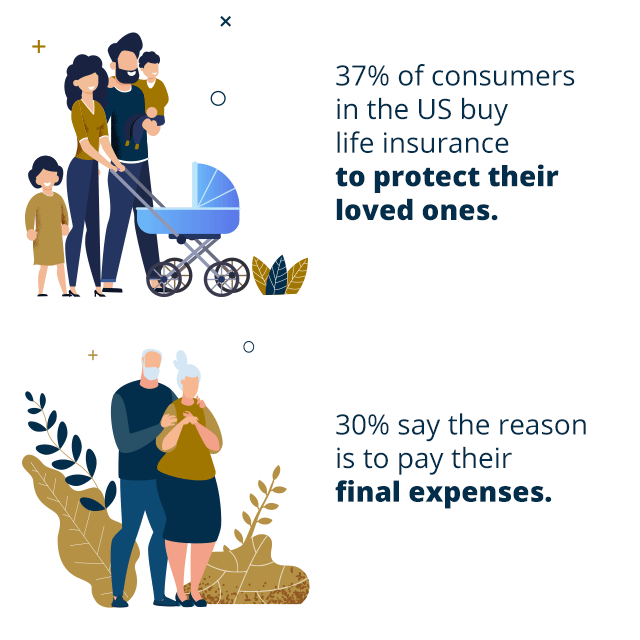

This strategy will allow you to think more clearly and calmly—and make better and informed decisions as a result. The benefits of mindfulness are especially important when purchasing life insurance, a process that requires thinking in the long-term while significantly impacting different aspects of your daily life, especially your finances. At the end of the day, it is a choice that will have an effect on your loved ones, family members, and friends, for better or for worse.

In essence, buying life insurance and practicing mindfulness both require a commitment to observation and deep thought, resulting in the self-awareness and inner peace needed to lead a fuller life and face its challenges. The process of evaluating the different aspects of our lives must take several factors into account, especially the following:

- What are your current circumstances? It’s important that you calmly and objectively consider your general circumstances. Analyze your health and that of your family, your financial and professional situation, and finally your risk factors. Being honest with yourself about these conditions is fundamental to finding the right life insurance policy at the best price for you.

- What are your priorities? Next, it’s a good idea to carefully determine your priorities. What role does your family play in your life? How important is your own health and well-being?

- What are your immediate needs? This question requires that you assess your family’s needs in the present. By analyzing their current lifestyle, you can calculate exactly what they will need to maintain it.

- What are your future needs? Once you know your present needs, you should think about how they might change in the future. What income should your family have in order to maintain a certain level of well-being ten or twenty years from now? This is a difficult analysis that requires your full attention to every relevant factor.

- What does the insurance companyoffer? Now that you’ve gathered the objective details about your life, you’ll have to evaluate what the insurer offers. You’ll have to determine whether the coverage they provide is adequate, the monthly payments are appropriate, and the benefits sufficient to cover your loved ones’ future needs. This is one of the most important steps, so make sure to have as much information at hand and compare different offers.

The five questions listed above will help you make the best and most informed decision regarding your life insurance. And these are not to be taken lightly: a life insurance policy can last your whole life, if it’s a permanent plan, or at least a significant period of time, such as 30 years, if it’s a term policy.

Finding Inner Peace

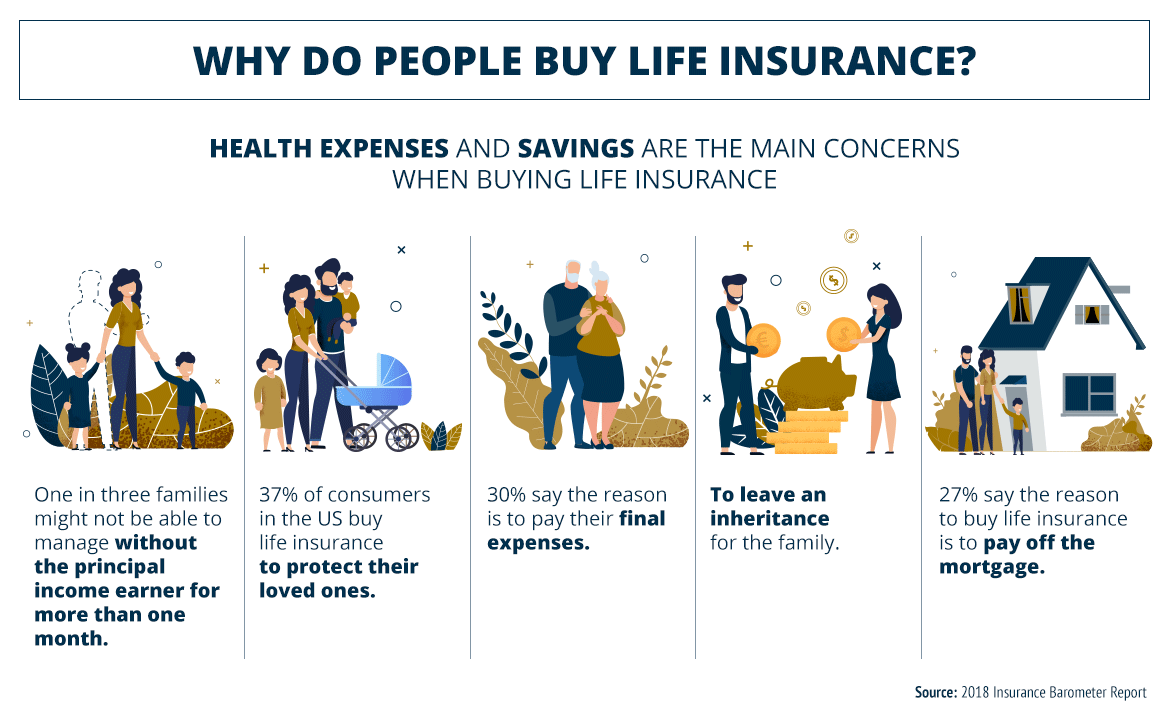

Many people decide to purchase a life insurance policy because they feel uneasy, nervous, or fearful about a certain aspect of their lives. In general, they worry that their family’s well-being or stability will be at risk if the principal income earner is no longer there to ensure their quality of life.

That’s why signing a policy, determining your coverage, and naming beneficiaries for the death benefit can bring calm and peace of mind. Life insurance can put an end to feelings of insecurity by minimizing risks and ensuring that your loved ones will be taken care of. This will make you feel increased serenity and tranquility as well as help you achieve a more relaxed state of mind that allows you to approach life with thoughtfulness and confidence. Just like mindfulness, having life insurance can help reduce levels of anxiety, stress, and depression, and improve your sense of ease, happiness, and optimism.

Of course, a policy does not improve your attitude and feelings about life by making your problems disappear; as with mindfulness, simply practicing this technique won’t eliminate the source of your worries. However, like mindfulness, a life insurance policy can help you take distance from certain issues and stop them from interfering with your day-to-day life. Meditation techniques are meant to refocus your attention on your actions and become fully aware of yourself and your surroundings, forging a new and lasting link between reality and conscience, between the here and now.

Sources:

Greater Good Science, Center at UC Berkeley, What Is Mindfulness?, American Psychological Association (APA): What are the benefits of mindfulness, Life Happens, 2019 Insurance Barometer Report, HolaDoctor, Seguros de Vida