In our business, solid and steady - especially when it comes to financial performance – are generally a result of disciplined risk management, hard work and proper planning. Our customers place their trust in PALIG’s financial strength and expect us to fulfill the promise that we’ll be there for them at some of the most critical times in their lives.

As such, we have made a concerted strategic effort to build our business in a way that will continue to generate consistent growth while preserving a sound foundation that helps guarantee our commitment to our policyholders. That approach bears out in another year of strong financial results for PALIG in 2018.

Last year, we continued our consistent trajectory of revenue growth, posting GAAP revenues of $1.1 billion, a 3 percent increase over 2017. Total premium grew 1 percent to $1.11 billion and pre-tax operating income rose by 6 percent to a record $93 million. Net income for 2018 decreased 5 percent to $73 million due to lower unrealized investment gains.

Those results build on a remarkable track record over the past decade. But solid and steady should not be mistaken for staying put, and we refuse to rest on our laurels. That is why we approached 2018 as a year of building for the future. A time to redouble our purpose and put our partnerships into action to ensure that our next decade will be as successful as the past one.

We focused our attention on investments that will strengthen the organization well into the future, including in leadership and talent development, systems and technology enhancements, new products and succession planning. We are now in a better position to take on the market with new leadership in key areas of the company and renewed momentum.

During my years as CEO, I have been fortunate to count on an extremely capable leadership team that has been instrumental to the transformation of Pan-American Life. Some of those leaders were looking forward to the time when they could embark on a different path and enjoy the hard-earned fruits of their labor. So, in 2018 we began implementing a succession planning process that has been years in the making.

Key executives such as John Foley, head of our U.S. Group Business; Stephen Batza, President of U.S. Life and President and longtime CEO of Mutual Trust Life Insurance Company; and Chief Investment Officer Rudy Revuelta all announced their retirements in 2018. And by the time you read these words, Patrick Fraizer, our General Counsel for more than ten years, will have also announced that he is leaving our leadership ranks.

All of them made invaluable contributions to our business, and while they departed with a wealth of experience and expertise, they took care to set the stage for a seamless transition to highly qualified individuals who are taking on their mantle with a refreshed vision for the company.

Bruce Parker and Robert DiCianni have assumed the leadership of our now two core operating units as President respectively of the Global Life and Global Benefits businesses. Steven Friedman, who had worked with PALIG in an advisory role over many years, is now Chief Investment Officer, and head of Corporate Development and Strategy. Bruce, Bob and Steve will help shape the future of PALIG for years to come.

In business operations, we invested in innovative enhancements such as service portals for customers, producers and providers, as well as group administration and financial systems in the Caribbean. In the U.S. Life business, we implemented ALIS enabling Mutual Trust to update its policy administration platform and more efficiently introduce new products, taking advantage of the latest technology and provide better service to policyholders.

We also launched Global Assets Indexed Universal Life for our Foreign National business, and Life Plus, a new product in Panama. We continue to strengthen our distribution relationships, adding new distributors in U.S. Group, and other key areas of the business. In Latin America we expanded our footprint with new offices in Bucaramanga and Cartagena (Colombia) and Guadalajara, Mexico.

All these investments will help position us for sustained growth and solid business performance in the future.

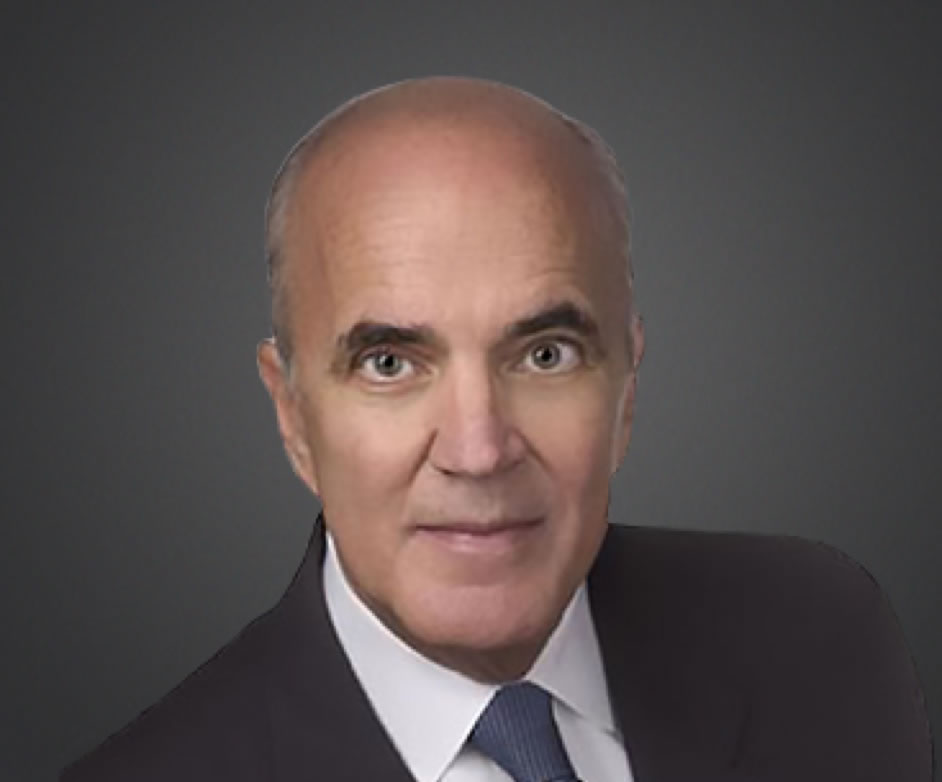

Before I bid my farewell, I’d like to extend a heartfelt thanks to Ken Mlekush, former President of Jefferson Pilot Life Insurance Company and PALIG Board Member, who retired from the board in 2018. At the time of his departure Ken was the current longest-serving Board member, holding that position for almost my entire tenure as CEO. I will always treasure the wisdom and counsel he imparted during those many years.

I am entering my 15th year with Pan-American Life Insurance Group and am as enthusiastic as ever about the prospects for our business. With our renewed leadership team and the smarts and dedication of all our PALIG colleagues I feel very confident of our path to continued success.

Sincerely,

José S. Suquet

Chairman of the Board, President & CEO

Read more