Pan-American Life Insurance Group delivered a stellar performance in 2017. What we’ve accomplished speaks volumes about the company we are today and will be tomorrow.

I state that with confidence, because I have witnessed first-hand what can result from the collective effort and collaboration that permeates at all levels of our organization as well as in our work with our external business partners and the markets we serve. This powerful dynamic has truly allowed us to become one PALIG, aligned under the common vision of improving our policyholders’ sense of wellbeing, while becoming the leading insurance carrier in the Americas. And that exceptional teamwork shows.

Teamwork shows in our financial performance.

PALIG has consistently delivered top-line revenue, premium and pre-tax operating income (PTOI) growth. In 2017 revenues grew 6.7 percent to reach a record $1.07 billion. Pre-tax operating earnings grew a strong 21.7 percent to $87.8 million. Net income for the year was $77.5 million, a 58 percent increase compared to 2016. Total assets now stand at $6 billion and total equity increased 14.5 percent to over $1 billion.

We exhibited strong performance across business lines, registering a combined growth of 7 percent in new sales and 3 percent in total premium. International Group and U.S. Life led the way with double digit growth in sales over 2016. This level of performance can only be achieved through the consistent, integrated effort of all our functional areas working together towards a common goal.

When we embarked on our 5-year strategic plan in 2014, we set aggressive targets for the year 2018. We surpassed those targets two years ahead of schedule. As a result, we’ve reset our expectations, embarking on a new 5-year plan with an eye towards 2021. Our new plan builds on our current performance and our strengths as an organization, focusing on four core areas:

- Organic growth of product business

- Investing in talent and technology

- Capitalizing on strategic market opportunities

- Investing in future wins

Teamwork shows in our ability to integrate new operations into the PALIG organization.

The exceptional performance of our U.S. Life business in 2017 is testament to the outstanding work our teams have done to integrate our U.S. Life operations in the United States. It has now been two years since the completion of the merger of Mutual Trust and Pan-American Life, and the highly effective integration of human, operational, and investment resources is showing clear results in the bottom line.

And in 2017, with the acquisition of HolaDoctor, we demonstrated yet again how PALIG can seamlessly add and integrate strategic assets that complement our existing operations to advance the company’s overall

mission and set us up for future success. Joining forces with the leading digital provider of health and wellness solutions for Hispanic audiences is a significant strategic initiative that both expands our presence in the U.S. Hispanic market and strengthens our position as a healthcare leader in Latin

America.

Teamwork shows in our operational excellence.

Day in and day out, I witness integrated cross-functional and cross-geography teams working together to deliver operational excellence, achieve our business objectives and build the footprint of our bright future. Over the past four years those teams have driven execution and margin improvement; tapped into new market opportunities and leveraged our growing scale; and strengthened our operational support functions to deliver improved responsiveness and customer service.

Our team has also shown resilience and come together to assist each other when parts of our organization have come under severe external stress, as was readily evident with a spate of natural disasters in 2017. We all pulled together to support our operation in Mexico in the aftermath of the earthquakes and did likewise after major hurricanes affected our colleagues in Texas, Florida, Puerto Rico and the Caribbean.

Without doubt, we are able to accomplish much more with support and trust as an anchor. At Pan-American Life Insurance Group every individual has the capacity to make a difference and drive business success. That capacity grows exponentially when we work hand in hand towards a common purpose, leveraging the best of what we each have to offer.

I don’t want to end my remarks this year without also noting a fabulous addition to our team on the Board of Directors. Suzanne Mestayer, Managing Principal of Thirty North Investments, LLC, will contribute her financial expertise as a member of the Audit and Finance Committee. In addition to her long and successful record as a financial services and banking professional, Suzanne has been a supporter and leader of several prominent community organizations and business groups in the New Orleans area.

I am proud to be a part of this great team and am looking forward to working in unison with all of my colleagues to make PALIG a bigger, stronger and more successful company for years to come.

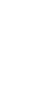

Sincerely,

José S. Suquet

Chairman of the Board, President & CEO

Read more